Oftentimes the NFT market presents “momentum trade” opportunities whereby a project has more buyers (demand) than sellers (supply), causing the price to breakout to the upside, giving you an opportunity to profit on the momentum.

There are 4 common momentum trade scenarios:

1. A new project mints out fast, causing high secondary demand aka. FOMO

2. The price of a project has been consolidating (stable), listings (supply) get reduced with demand remaining constant

3. An existing project makes a notable announcement or a notable collectors (influencer / celeb) buys into a project

4. A top trending project loses momentum and falls to a strong area of support (demand)

In all scenarios the best way to determine if a project is breaking out is to observe the amount of sales (volume), on either 1-5 minute time frames for new or top trending projects or a high time frame (30-60 minutes) for established projects that have a price consolidation.

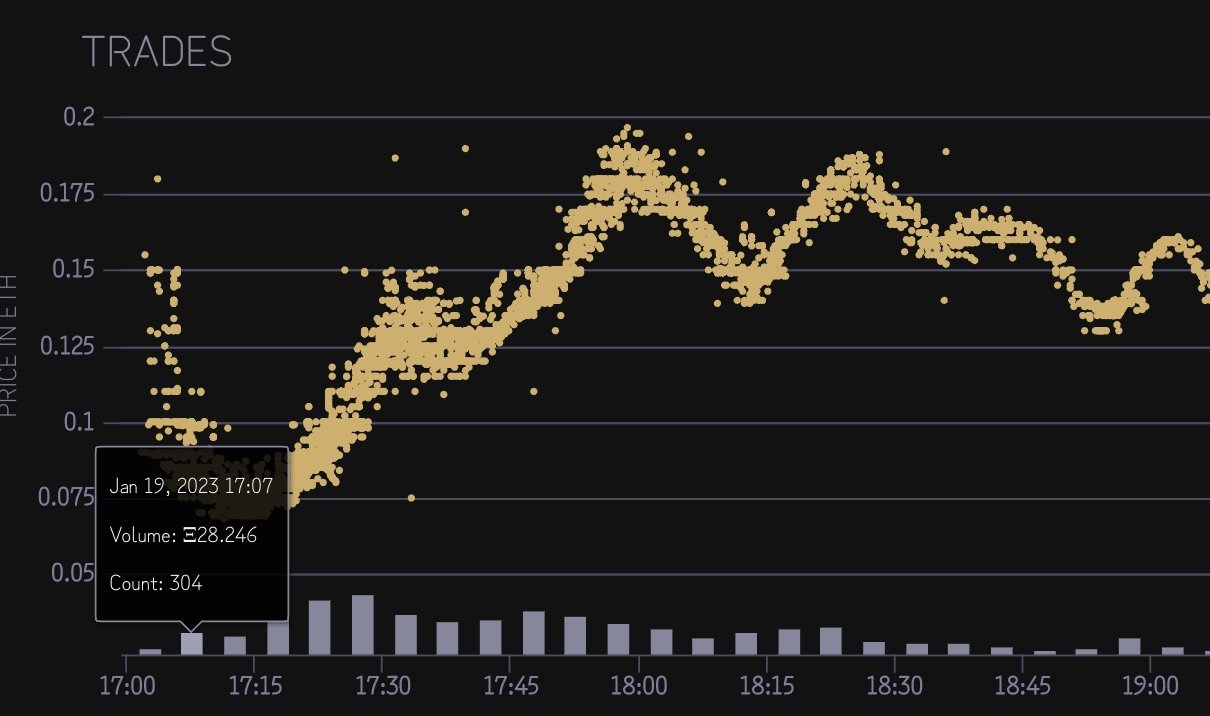

Scenario 1 Example: HasbullaNFT saw extremely fast secondary demand after selling out their whitelist mint instantly at a price of 0.069e.

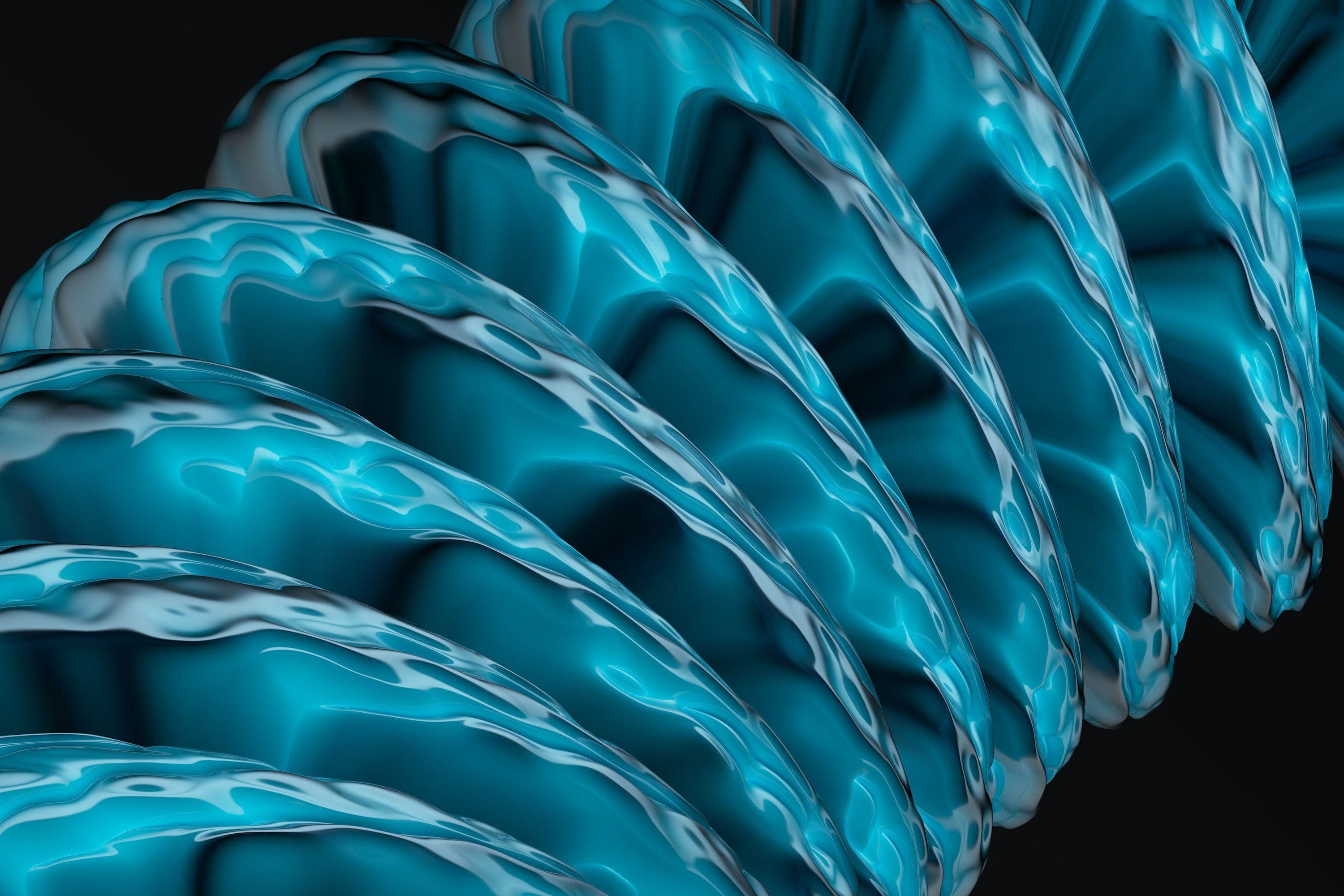

This snapshot of the 5 minute sales from NFT Nerds shows there were 304 sales, indicating a high secondary demand at ~0.07e.

Due to the high volume of sales, our custom discord utility tool signalled this project was gaining demand and allowed our members to buy in early on the momentum of this trade.

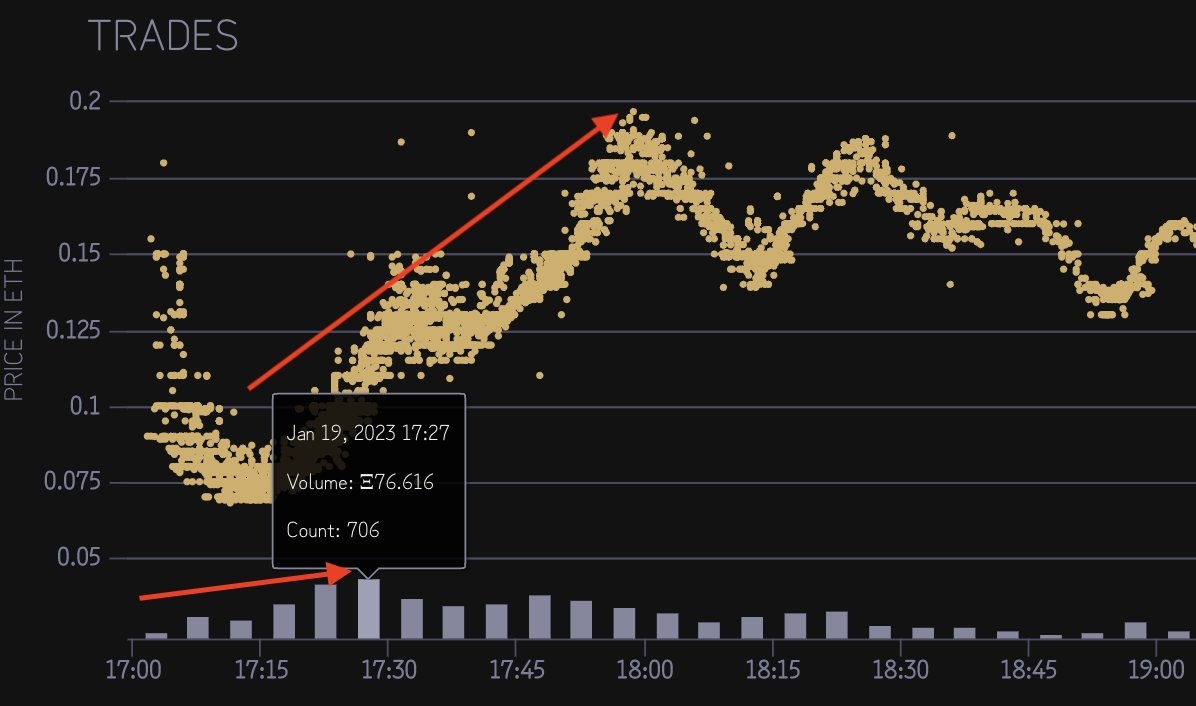

Within 30 minutes, as demand (sales) continued to trend upwards, price continued to climb in tandem due to the limited number of supply (listings).

TLDR; When there are more buyers than sellers, the price goes up.

Price is a lag indicator of volume.

As you can see from the chart above, volume (sales) trending upwards on the 5 minute time frame is a precursor to the price increase that eventually topped around 0.19e (~2.5x return for minters and early secondary buyers).

Scenario 2 Example:

Sewer Pass by BAYC has seen consistent sales for almost a week since they dropped and teased what was coming with this curiosity-driven sketch drawing.

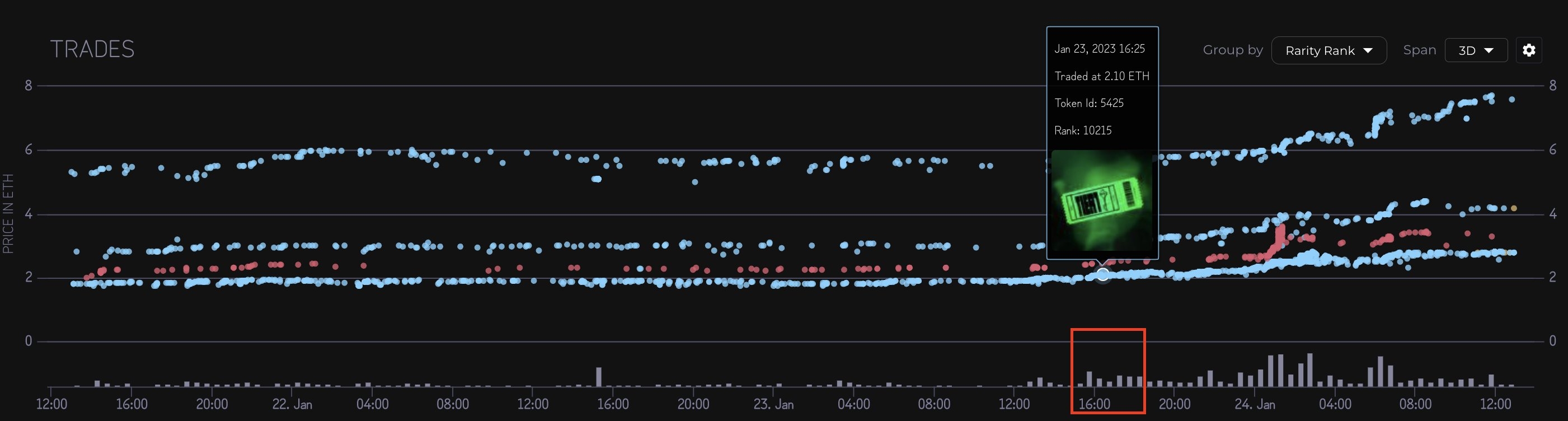

The tier 1 floor pass price was stable at 1.8e-1.9e for several days, in addition the higher tiers have been stable in their respective price range.

Signs of a strong breakout (momentum trade opportunity) started to show on 23rd Jan at 16:00 UTC with 63 sales in 30 minutes.

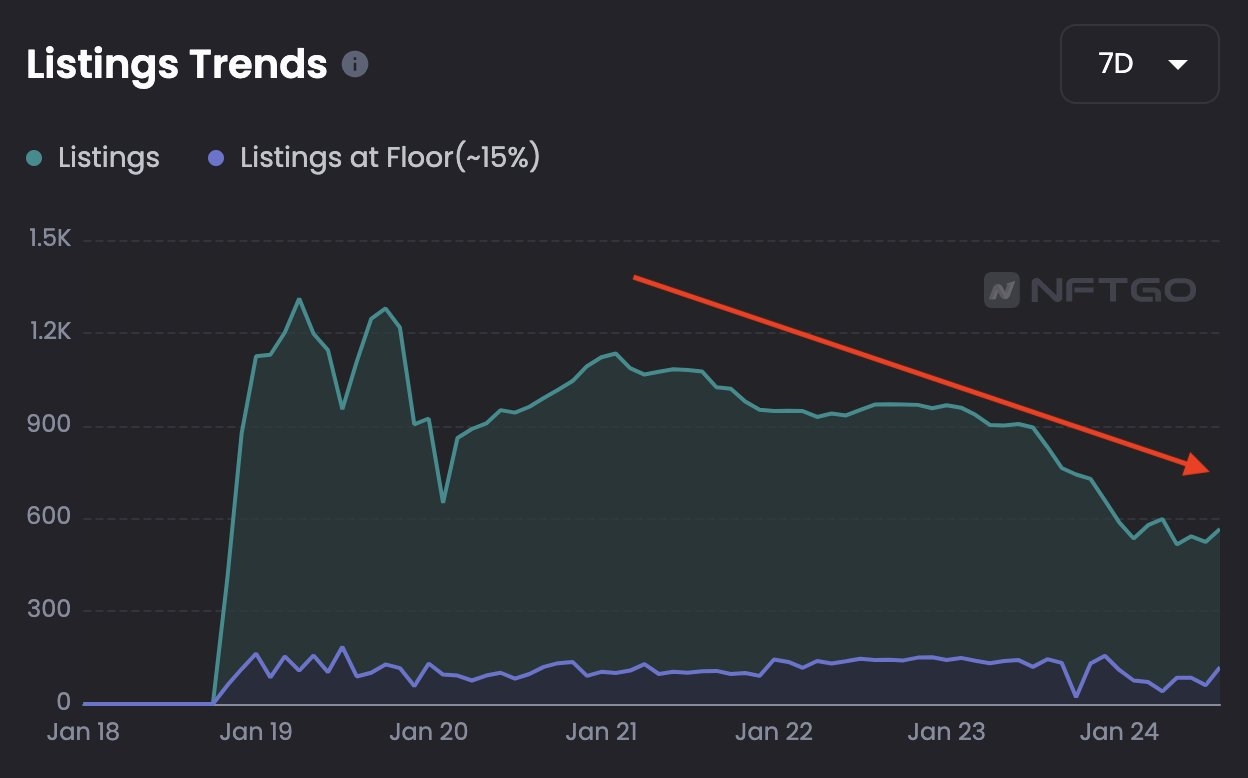

As demand remained constant the floor price for Sewer Passes continued to move higher as listings were trending downwards since 21st Jan.

The chart above from NFTGo shows total listings on a steady decline which eventually caused a supply squeeze.

Tier 1 pass price ascended to ~2.5-2.8e (~0.7-0.9e profit) and tier 4 passes peaked to all-time-high at 7.7e from the 6e consolidation level (~1.7e profit).

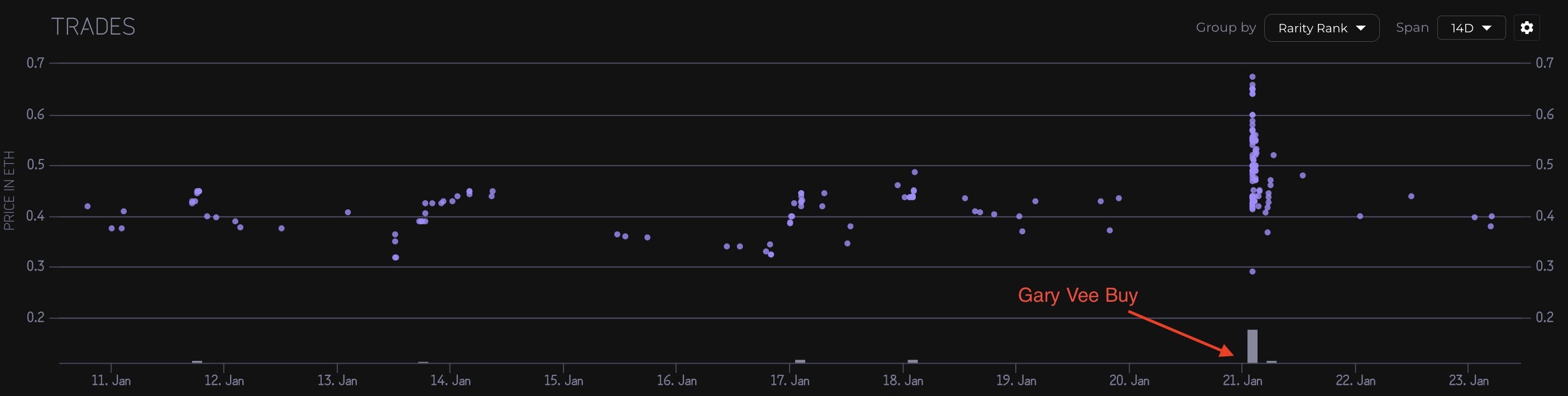

Key Consideration: If a catalyst (big announcement or influencer buy in) causes FOMO, oftentimes it is followed by a fast sell off and retracement back to key price levels, if demand is not sustained.

This was evident after Gary Vee swept several MNTG passes, causing FOMO buys from a 0.4e floor price up to 0.67e within minutes but the lack of demand caused price to fall back to 0.4e within 24 hours leaving several people holding the bag on a failed attempt to momentum trade.

As we’ve identified, there are several strategies you can deploy when it comes to momentum trading.

The strategy that best suits you will depend on your liquidity, risk tolerance and preferred time-frame so back test and commit to what gives you the best results.

To gain access to our volume monitor, other custom NFT trading tools and strategies, join our community by purchasing a season 1 pass here:

https://opensea.io/collection/underground-pass