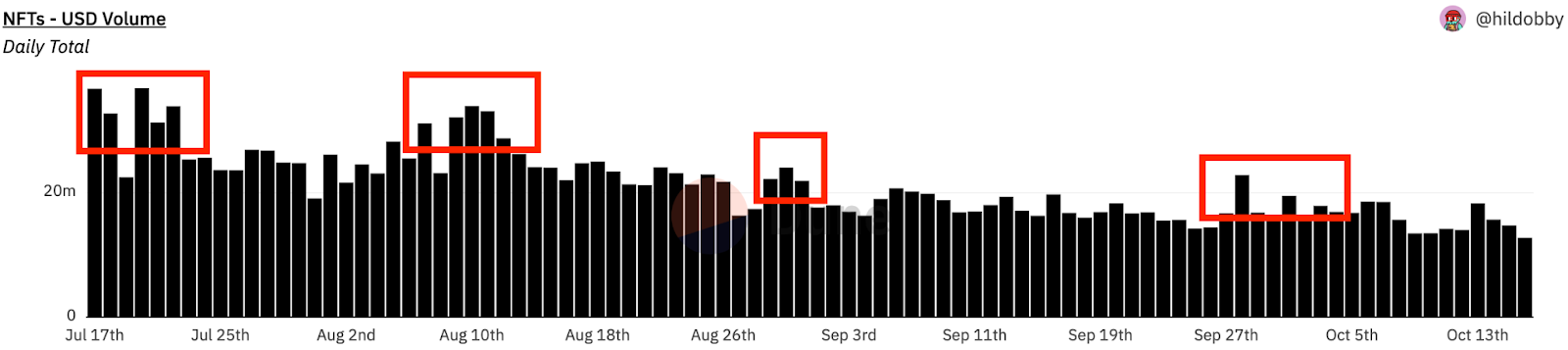

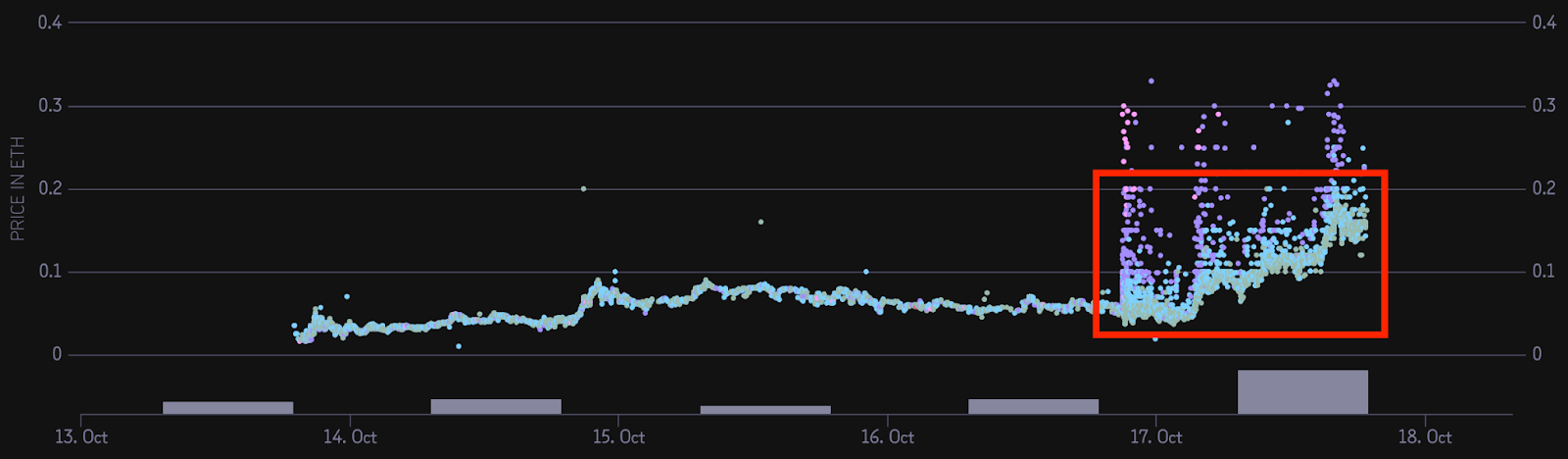

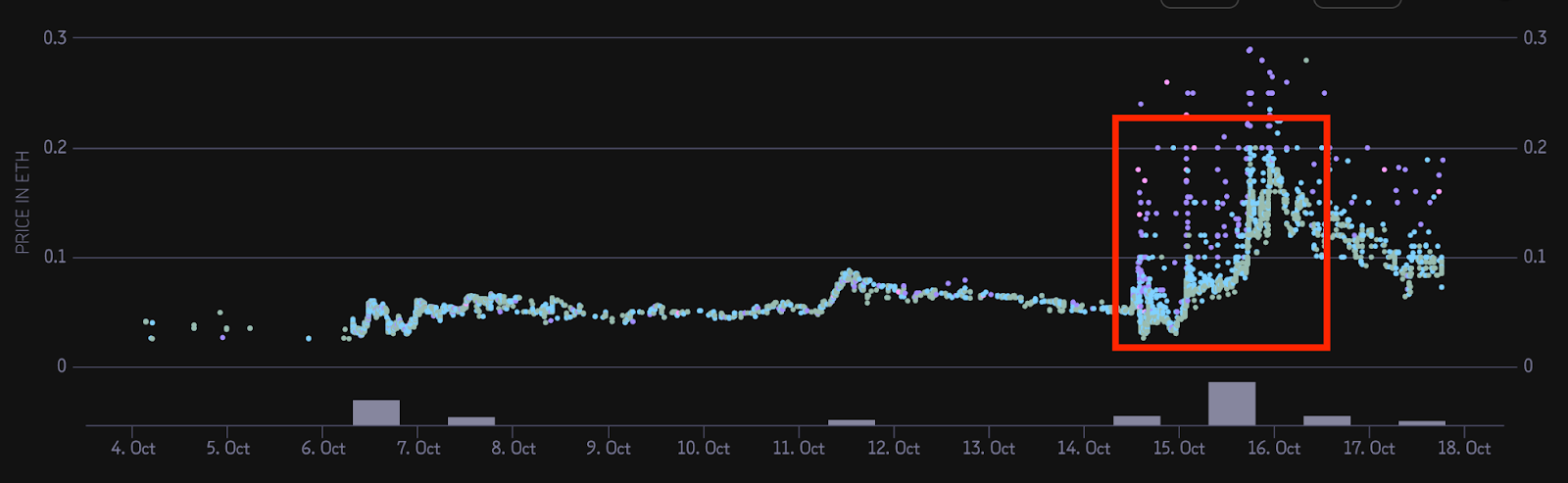

Taking a macro look at the NFT market we can see that we are going through short (4-7 day) periods of increased trading volume, followed by retracements across top and mid tier projects, but most notably with new mints.

What we can learn from this increase in volume is that there are trends that lead to these movements and it differs from how the NFT market would previously gain volume during the bull run.

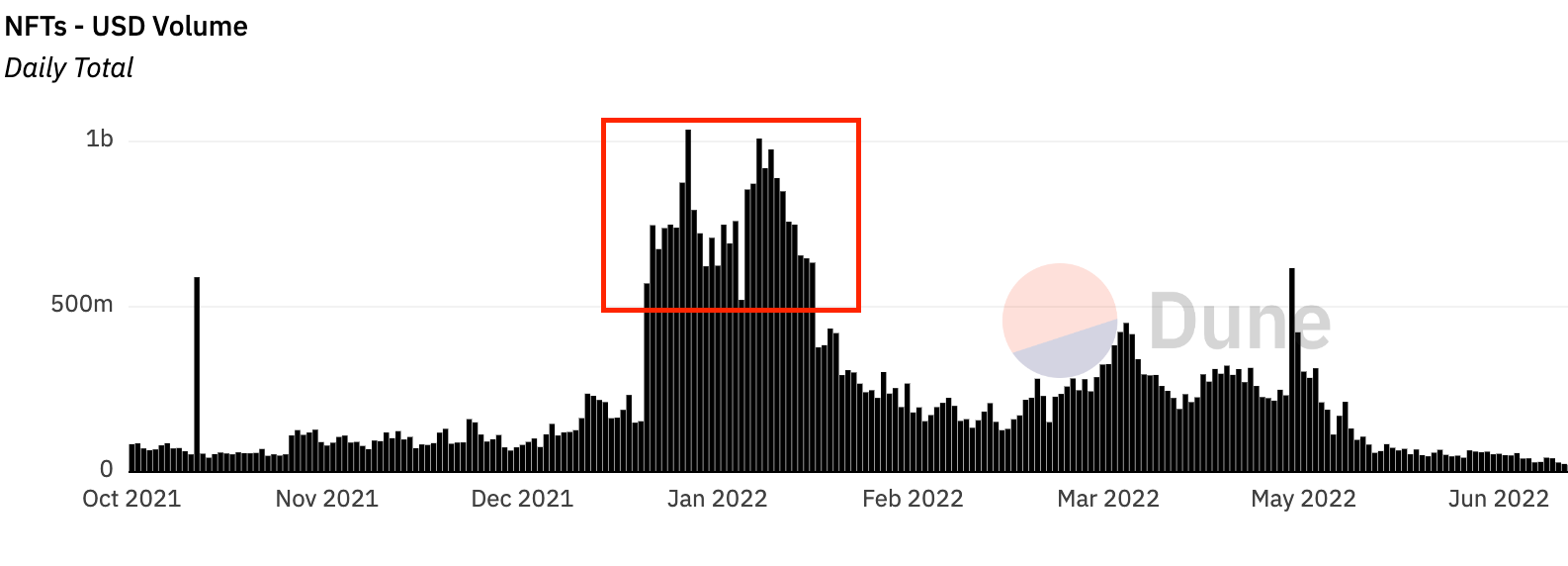

Typically we saw NFT volume increase when the price of ETH decreased.

This was cyclical and for every big red candle on ETH, NFT price and volume took on a life of its own and moved in the opposite direction.

We can put this down to traders and investors possibly wanting to maintain the USD value of their NFT and therefore price accordingly - regardless of ETH as a value in itself.

This rising movement in NFT volume came to an end when the overall risk asset markets (stocks and crypto) were deemed “high risk” as fears of a recession loomed over investors.

Currently the NFT market usually gets an uptick in volume when ETH price stays constant and consolidates at various ranges.

This could be due to investors feeling “comfortable” holding ETH and looking for ways to compound their ETH holdings.

So what is the best way to interpret this understanding of the general macro?Positive macro sentiment and/or ETH ranging sideways = Increase in NFT volume (more of a short-term “risk on” environment)

During this period, great projects with strong fundamentals and reasonable mint prices perform well. Currently we’re seeing many low-price paid mint projects sell out, and great art projects performing well post-reveal, demonstrating that there is more confidence coming back to NFTs.

When we see ETH price volatility back with aggressive movements up or down, we typically see NFT investors on the sidelines trying to preserve their ETH for either selling, or holding and therefore NFT trading volume starts to decline.

Taking advantage of these periods where new projects are minting out and gaining volume is one of the best ways to capitalise on the market cycles.

We are committed to capturing these opportunities daily. Purchase a pass here to gain access today.

This article is a speculative assumption from recent market observations. None of this is intended as financial advice or true market data but shares some observations our team have speculated having been through the ups and downs of the NFT cycles.